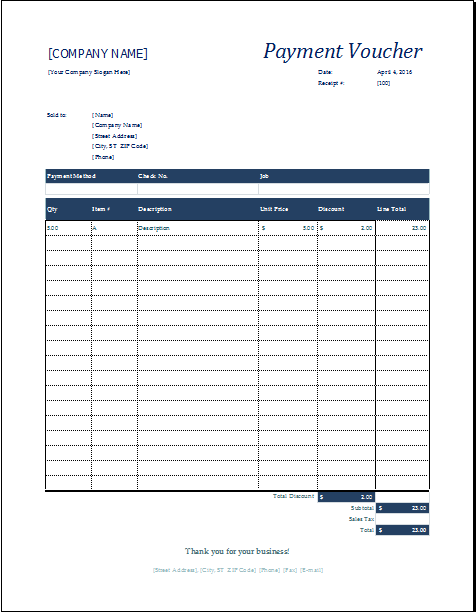

Many people make payments on business days. Businesses also pay money to various clients and sellers. In other words, they keep dealing with cash and other modes of payment. Remembering each and every payment and the details of who paid it, what the amount was, on what time and date it was paid, and some other pertinent details is not possible. Therefore, people use a document that is commonly used as a payment voucher.

What is a payment voucher?

A payment voucher is a financial document that is used to keep a record of the transaction that takes place between the business and its customers. Payment vouchers are generally used to perform different types of transactions, such as the payment of utility bills, the payment of salaries to employees, and all other expenses.

What information is provided by the payment voucher template?

The template that we use to keep track of the transaction is a ready-made form in which there are different empty fields. Every time you feel the need to issue the voucher, you will fill in those empty fields and then take a printout of the document to share it with the person who has paid the money. Let us see what details are given in the payment record-keeping document:

A unique voucher number

Just like business invoices, vouchers also have a unique number that helps people identify them. If a voucher gets lost or damaged, the user can get it reissued with the help of a unique number. This is important information, and every business assigns this number according to its system of issuance.

Date

The date on which this record-keeping coupon is issued is important to mention. Some coupons have an expiration date, and if people fail to pay by that date, they have to pay the bill after the due date, which often makes it compulsory for them to make the payment with a penalty. Therefore, mentioning dates is very important. In addition, it is important to mention the due date.

Details of the recipient of the payment

The name of the person or company that is receiving the payment should be mentioned in it. In most cases, the issuer is the recipient of the payment, and he issues it by adding the name of the business, logo, and a complete header on the top of the voucher.

Payment method

This part of the voucher mentions the mode of payment the person has used to pay the money. This can be through debit or credit cards, in the form of cash, online transactions through applications, and many other modes.

Title of the payment

Every payment is made with a reason or purpose. This is usually specified by the title. For instance, if a business is paying a salary to its employee, the title of the payment will be ‘’salary of the employee’’. This shows the purpose of the payment.

Account details

Money is usually transferred to the person’s account. Therefore, account details where the payment has been made should also be stated in the voucher. This section should include the account number, bank name, branch number, and some other details depending on the mode of payment. If you are sending money to a mobile account, you will only have to provide the mobile number.

Details of the person authorizing the payment

Here, the name of the person who is allowed to pay the recipient of the money should be mentioned. Beneath his name, there should be some space where he can affix his signature.

Is using a template useful?

Since every payment coupon has the same purpose, the details to be added to it and the format of every voucher are more or less the same. Those who want to use it should always keep the purpose in mind and then, they will not have any problem with the format as long as it is fulfilling their needs.

The template provides a ready-made record of transactions, so people don’t have to put extra effort into creating it from scratch and then adding details to it.